More on 10 year treasury curve fitting

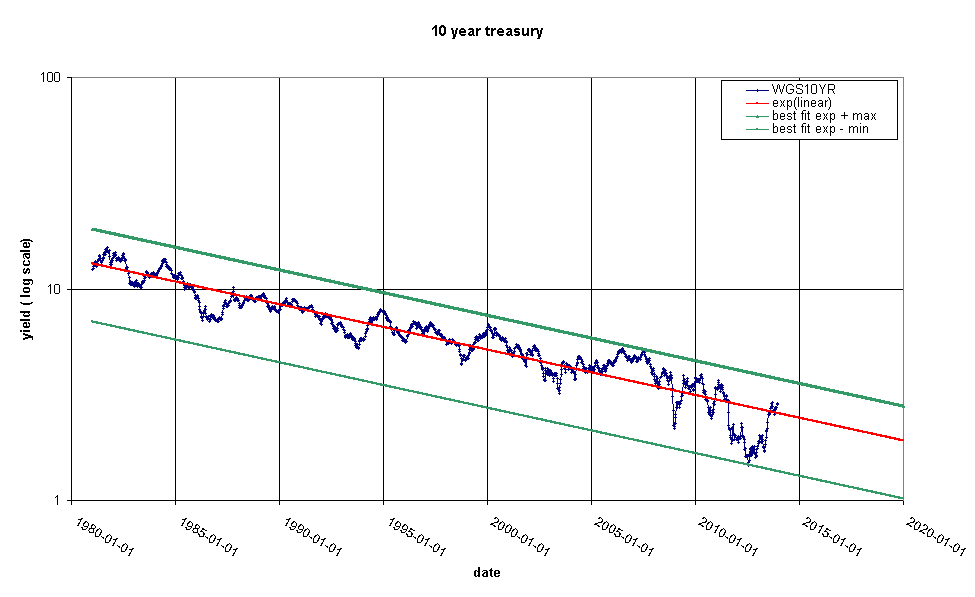

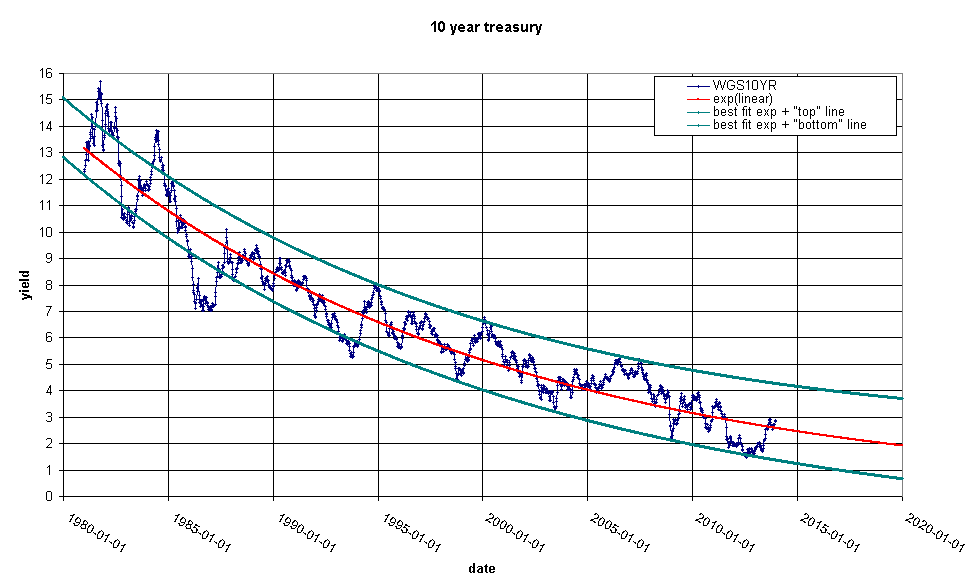

Yesterday I introduced the 10 year treasury curve fit. This is

the same chart with a log scale to help show how I constructed the

green line in the original chart. Note that the green lines are

parallel to the red line, but displaced to pass through the highest

and lowest points on the blue curve.

This technique shows the maximum excursions from the red line that

have been obtained to date, but doesn't do much for prediction.

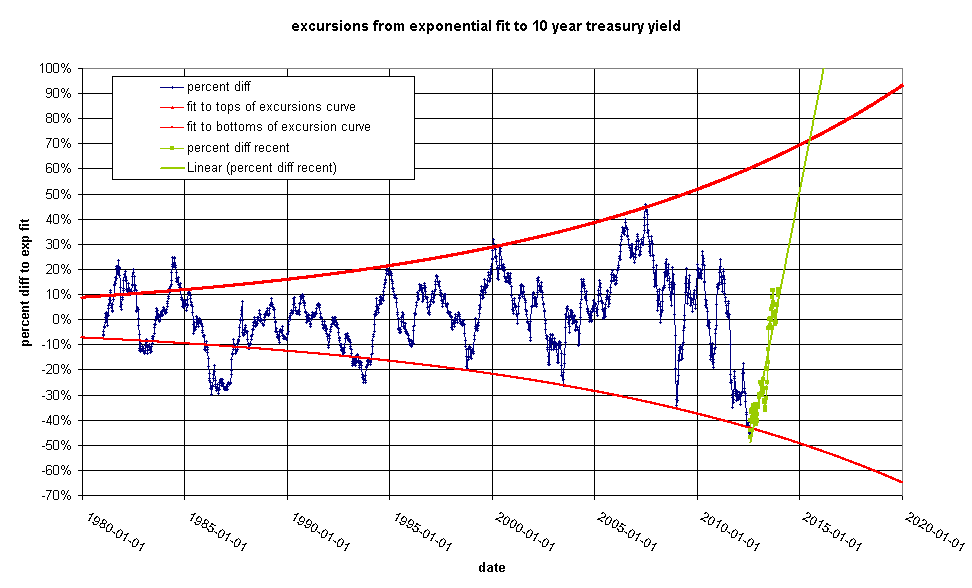

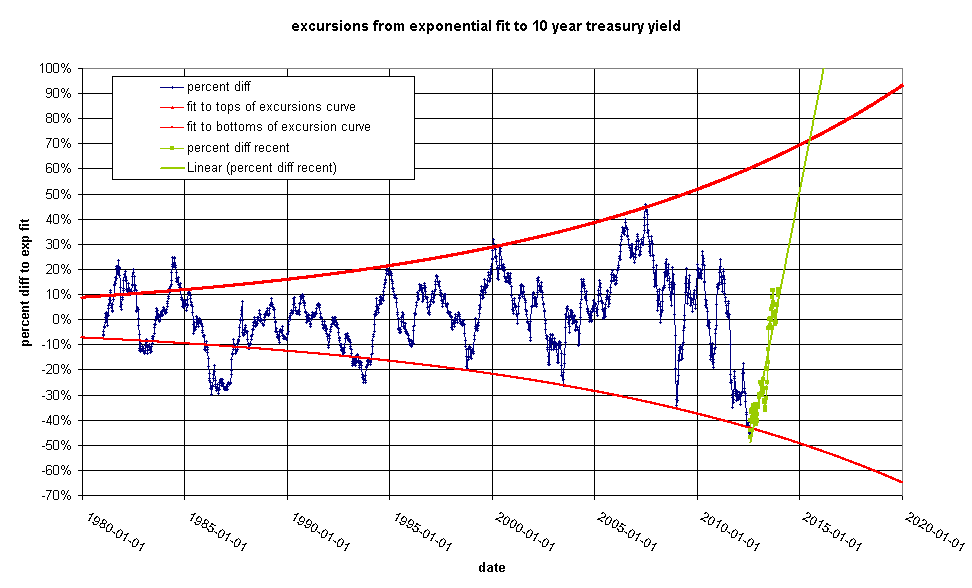

Let's look again at the excursion chart:

I have added exponential fits to the top and bottom points since

about 1994 and extended them out to 2020. I have also highlighted

recent movements in green and added a trend-line. The green line

intersects the top red line in mid-2015. The excursion would then

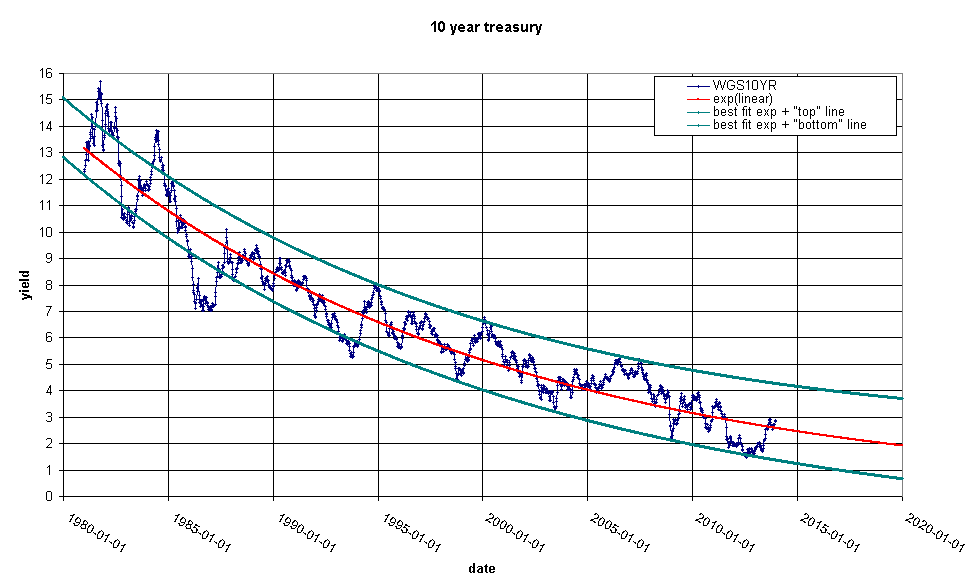

be about 70%. This is what the original chart would look like with

the red lines from above substituted for the green lines:

Take a moment to reassure yourself that this curve accurately

represents the recent past. If the upper red line in chart two can

be believed, the yield in mid 2015 would be about 4.1%.

What does this mean? It means that the Federal Reserve will have

lost control of the 10 year treasury yield. It looks to me like the

Fed has been maintaining a glide path for treasuries where yields

drop by a fixed percentage each year, but it is getting harder and

harder to keep them on track. When yields get too low, they give

them a whack. When they get too high, they give them a whack in the

other direction. But this is a losing battle. They are seeing

greater and greater moves away from the red line and they will soon

not be able to control yields at all. A yield of 4.1% in 2015 would

mean that the 10 year is 70% off from it's target. Effectively the

Fed will be saying it cannot control the bond market anymore. This

would be the end of a organized bond market.