10 year treasury yield

Fitting a curve to the 10 year treasury yield gives some

interesting results.

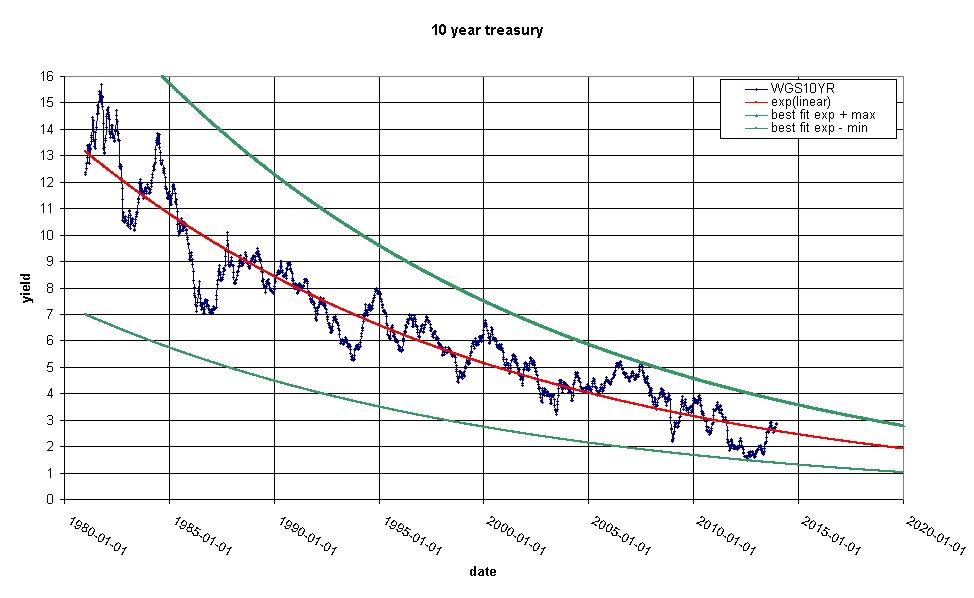

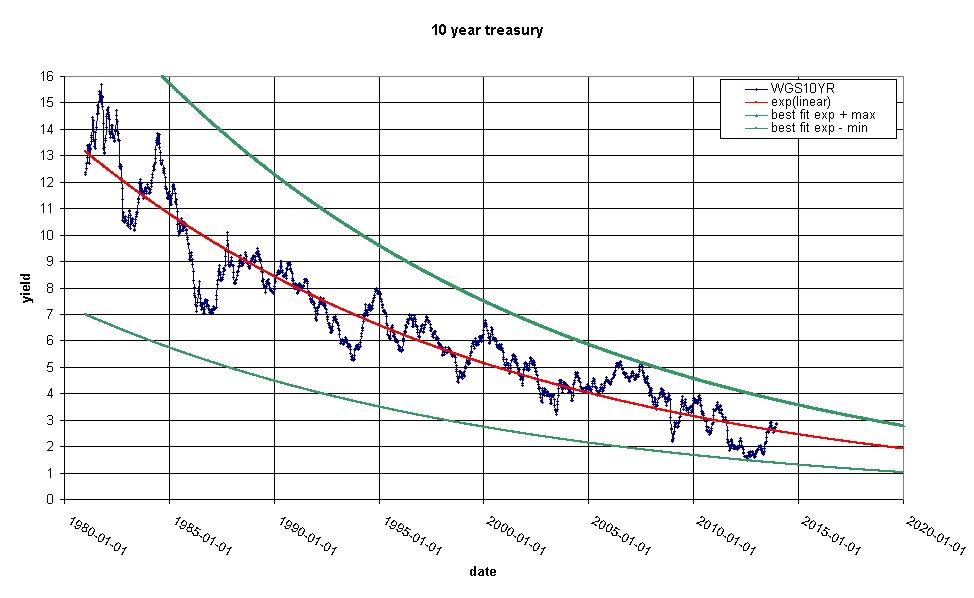

This is an exponential fit to the 10 year treasury yield since

1982. The red line is an exponential fit to the data and the green

lines are exponentials that pass through the maximum or minimum

points on the blue curve relative to the red line. Note that the

size of the excursions from the red line are increasing. This curve

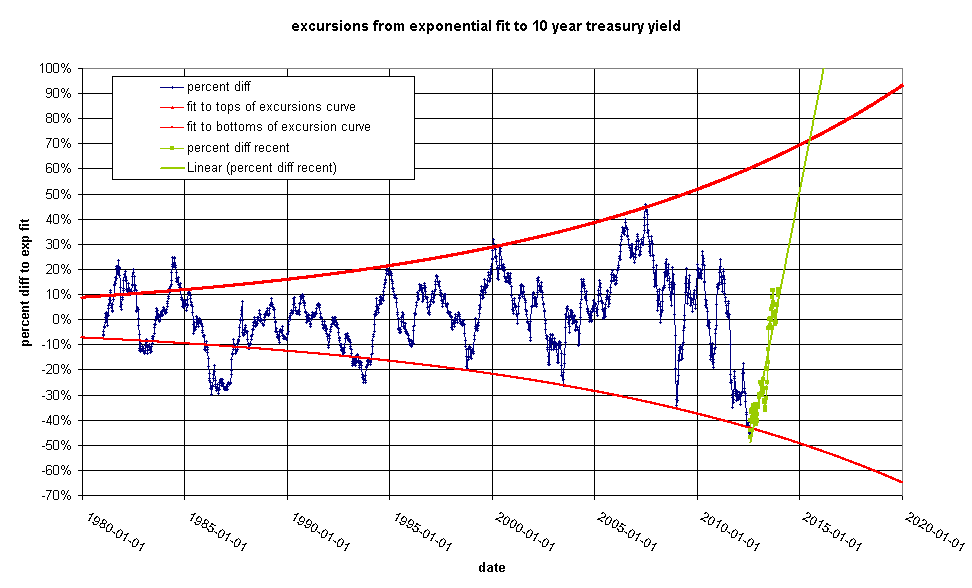

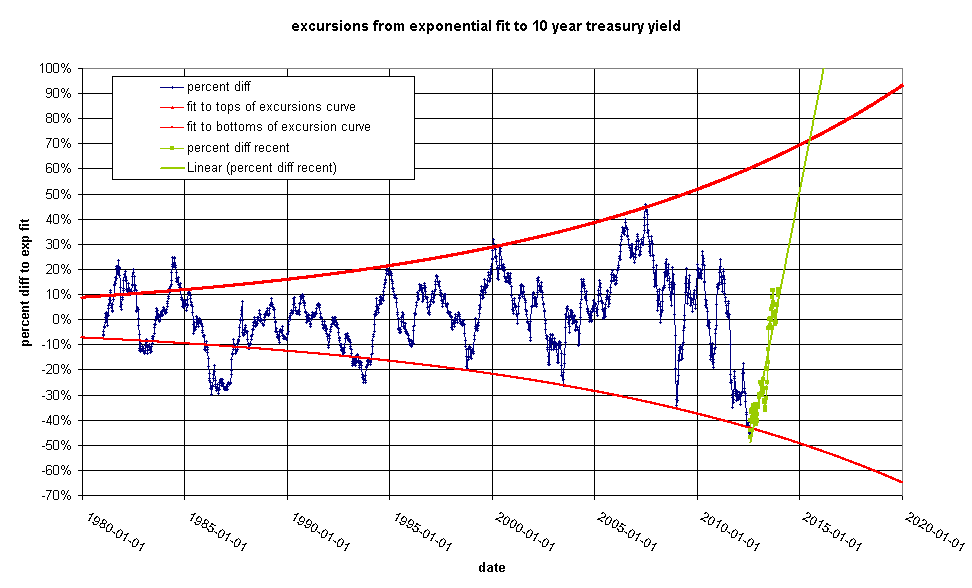

quantifies the difference:

For purposes of argument, let's suppose that we see a 50% upswing

by 1-Jan-2015. This would be a value of 3.675%/year. Today this

doesn't look like a huge jump. We are looking at 3% on the nose as

of Friday 27-Dec-2013, but in fact due to the fact that the green

lines are converging, this is a dramatic departure from previous

behavior.